You Are The Bank Now - #105

TL;DR: Setting up your own banking infrastructure in a basic way and adding a little privacy in the mix.

Dear Reader,

In the Bitcoin economy, self custody is the name of the game… but not everyone knows how to play it.

Because there’s no 1-800 number or customer service rep to reach out to when things go wrong, many people feel much more at ease letting centralized exchanges (CEX) manage the custody of their money. And while CEXes may provide a level of comfort by providing individuals with support lines and automatically transaction tracking, it ultimately turns them into the entity we’re upgrading from: banks.

And if you haven’t been paying attention to the recent bank freezes1 and crypto “bank” runs2 in recent months; just remember: “If you don’t hold it, you don’t own it,” or another way of saying, “Not your keys, not your coins.”

Self custody can seem intimidating, overly technical and maybe out of reach for many people.

I hope the following ideas can help inspire some confidence by showing a simple method to the self custody madness.

I’ve been using this setup for a little under a year and has done pretty well for me and my business. So, if I can do it, I think you can do it too, if not better.

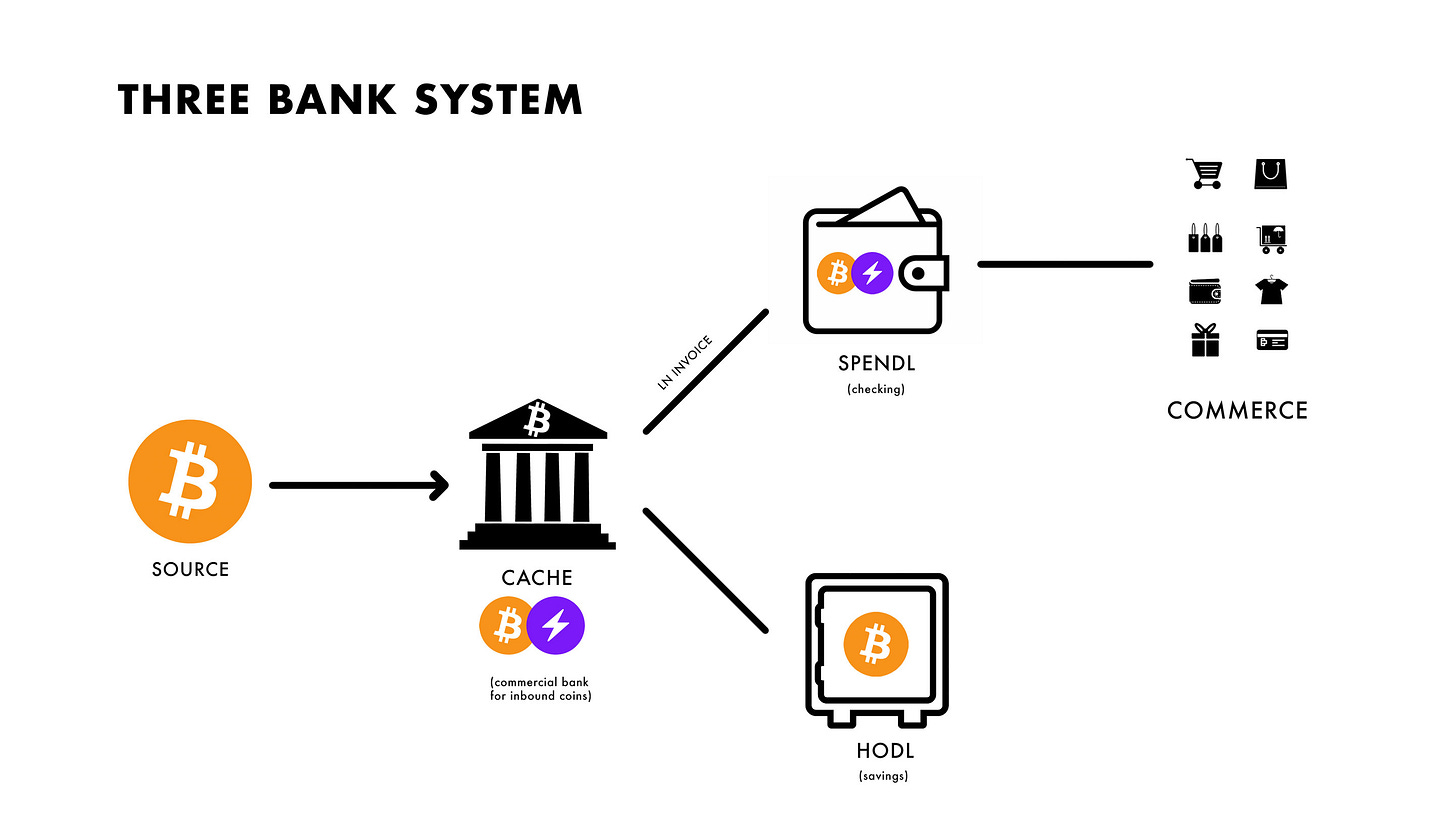

The Three Bank System

Credit goes to DarthCoin and Dap for sharing these ideas. I’m just breaking it down for the everyman like myself.

The main idea with the Three Bank Structure (3BS) is to help compartmentalize devices giving them roles and helping to create some privacy and security.

Cache (operating)

Think of this as your commercial bank which would be responsible for inbound coins from a job or an exchange, KYC or non-KYC.

This would be your operating account containing enough funds for when you need it.

Spendl (checking)

This would be your mobile On-Chain (OC) or Lightning Network (LN) wallet for any walking around money, just like your traditional wallet.

Think of this as your checking account.

Hodl (savings)

As the name implies, this is your central bank holding long term reserves, stored in a hardware wallet.

Think of this as your savings account.

Workflow

Sourced Bitcoin can be from a plethora of places regardless of KYC or not.

1 - Source to Cache

Your Cache, or commercial bank, would be your primary point for inbound coins. A simple Cache wallet could be something like Muun or Breez which offers OC and LN functions via Submarine Swap.

A submarine swap is a swapping provider which routes funds through others within the network thus adding a layer of forward-moving obfuscation when you move funds to its final destination.

Note:

If you’re using a desktop wallet such as Sparrow Wallet which has a built in mixing feature, you don’t need two OC/LN wallets. You can just send inbound coins to Sparrow, mix, then send out to Spendl and Hodl wallets. This does require you to run a full Bitcoin node though.

2 - Cache A>< B

If the source is capable of LN transactions, you can skip this step.

From the Cache A , you would create an invoice to another OC/LN wallet (Cache B) to move funds, thus generating “new” coins (or unspent transaction outputs aka UTXOs). This is a “poor mans” way of creating a faux coinjoin/mix without being a tech wiz.

3a - Cache to Spendl

From Cache B, you can transfer funds to another OC/LN, OC or LN only wallets for your everyday spending.

Because many Bitcoin wallets are free open source software (FOSS), you’re not limited to the number of wallets you can to use. Keeping track of all your seed phrases might seem like a hassle, but the idea of Spendl wallets is that you’re putting enough funds to get you through the day.

3b - Cache to Hodl

From Cache B, you can send funds to your Hodl Wallet for long term storing. You can feel a little more secure about your privacy as you’ve received new UTXOs from Cache B.

With regards to hardware wallets (HWW): some people believe you need to purchase a device like a Trezor, Ledger or ColdCard. While they’re not terrible products, and they might work for your needs; the vendors require you to provide details about yourself which can compromise your privacy.

A simple HWW could be an old desktop or laptop running Bitcoin Core, a Raspberry Pi with Umbrel, MyNode — or whatever you’re comfortable with — that you connect to from time to time.

Remember to keep it simple

If you design a workflow that’s too complicated and bulky, it becomes too cumbersome to use. When it’s cumbersome, you may become discouraged from using it.

Keep it simple, make improvements along the way.

This method is by no means perfect, but it gets the job done. You can make improvements along the way, or maybe you find a more efficient and effective way of self-banking.

Conclusion

Privacy is a human right.

You have the right to not be spied on, to have social boundaries, to build trust among your peers, and protection of your speech and thought.

The ability to transact is a means of communication, it’s speech, and you have every right to be able to express what you feel has value to you without being spied, censored or have your ideas and voice stolen.

3BS is just one of many methods out there of creating your own banking system which offers security and privacy of your funds by having your coins spread across a few different baskets each designated with specific purposes.

Self custody is the name of the game, but it requires responsibility.

You are the bank now.

Until next time!

https://www.hcamag.com/ca/news/general/canada-freezes-bank-accounts-of-people-linked-to-protests/326036

https://fortune.com/2022/06/14/celsius-meltdown-bank-run-crypto-crash-regulation-finance-gene-grant/