Yielding Sound Money - #309

TL;DR: How platforms like Thorchain enables yield in a sound money world.

Reader,

Can you earn yield on Bitcoin?

Michael Saylor and Saifedean Ammous had a debate around it recently.

Saylor thinks traditional banks can make it happen. Saif's isn’t so sure.

So the question is…

Can Bitcoin generate yield?

Saylor's Perspective

Saylor, through a traditional finance lens, see’s Bitcoin as a financial asset.

That banks, once allowed to custody Bitcoin, will be able to connect lenders and borrowers under “adult supervision.”

The ability to borrow against the asset, not just for collateral loans, but in a traditional savings and loans scenario, is ideal. It’ll bring bigger, more mature, investment capital to the space.

Saifedean’s Viewpoint

He believes Bitcoin is sound money. A tool used for savings to preserve wealth. Earning yield is not necessary.

Saif’s skeptical about yield earning given the collapse of centralized exchanges, CEXs, like FTX, BlockFi and Celsius. And without a lender of last resorts, the losses on Bitcoin can be too severe.

His view is simple: Hold bitcoin, then use it when needed.

Overlooked Details

They both agree: Bitcoin’s important to the future of money. Where they differ is on how it’s to be used.

Is there a way to earn yield while staying decentralized and true to sound money principles?

Is there something they both overlooked?

Let’s look at the concept of lending and borrowing through the eye of the Austrians.

Lending and Borrowing

Time Preference

People prefer goods now rather than later. This is called time preference.

It's a basic human trait. If you have an apple today, you value it more than an apple promised next week. This preference shapes how we make decisions.

When you lend someone money, you give up something today. You expect to get more in the future. Interest is the reward you get for waiting. It's the price of time.

Different people value time differently. That's why interest rates vary.

Interest rates are natural.

They emerge from people's time preferences. In Austrian Economics, this is key. It explains why lending and borrowing happen.

The Role of Savings in Economic Growth

Savings are important.

When people save, they don't consume all their income. They set aside some for the future. This creates a pool of capital. Businesses can borrow this capital to invest. They can build factories, buy equipment, or hire workers.

Voluntary lending and borrowing drive growth.

Savers choose to lend their money. Borrowers use it to create value. Both sides benefit. The economy grows as a result.

In Austrian Economics, savings fuel investment. Investment leads to more production. More production means more goods and services. This improves living standards.

No Lender of Last Resort

In a sound money system, there's no central bank or lender of last resort. This means that if a bank fails, it fails. No bailout.

Without a central authority, the market regulates itself.

They assess the risk. They lend their money. If it fails, they bear the risk. If it succeeds, they reap the reward.

Bad actors are weeded out. Good practices are rewarded. This creates a healthy financial system and promotes responsibility.

Borrowing and Lending on a Bitcoin Standard

Bitcoin has a fixed supply or 21 million coins.

However, some coins are lost forever, so the actual supply is less. How can borrowing and lending work with a fixed supply?

Earning Yield with a Fixed Supply

In a fiat system, central banks can create currency.

They can increase or decrease the currency supply, affecting interest rates. When interest rates are low, the cost to borrow is cheap. Easy capital often leads to poor investment decisions. When interest rates are high, the cost to borrow is expensive. Lenders become cautious, thus controlling capital flows.

But with Bitcoin, the supply is capped. You can't create more coins to lend out. So, how can you earn yield?

Yield comes from the willingness of borrowers to pay interest.

Even with a fixed supply, people still have time preferences. They may need Bitcoin now rather than later. They'll pay interest to get it.

Lenders have Bitcoin they can spare for a time.

They want a return for parting with it. Interest rates adjust based on supply and demand. If many people want to borrow Bitcoin, interest rates rise. If few want to borrow, rates fall.

Borrowing and Lending in Fiat vs. Bitcoin

In fiat systems, banks can lend out more money than they have. This is called fractional reserve banking. It leads to inflation. More money chases the same amount of goods. Prices rise.

With Bitcoin, fractional reserve banking is harder, but not impossible. The blockchain is transparent. You can see how much Bitcoin exists. Lending more than you have is risky.

Borrowing and lending in Bitcoin are more straightforward. You lend actual coins you own. Borrowers receive real Bitcoin. There's no magic increase in supply.

Possibility of Earning Yield

Even with a fixed supply, earning yield is possible. Interest rates are the price of borrowing money. They emerge from the market. They reflect people's time preferences.

On a Bitcoin standard, lending and borrowing can thrive. People with surplus Bitcoin can lend it out. Those who need it can borrow. The fixed supply ensures that inflation doesn't erode value.

Thorchain: Merging Austrian Economics with DeFi

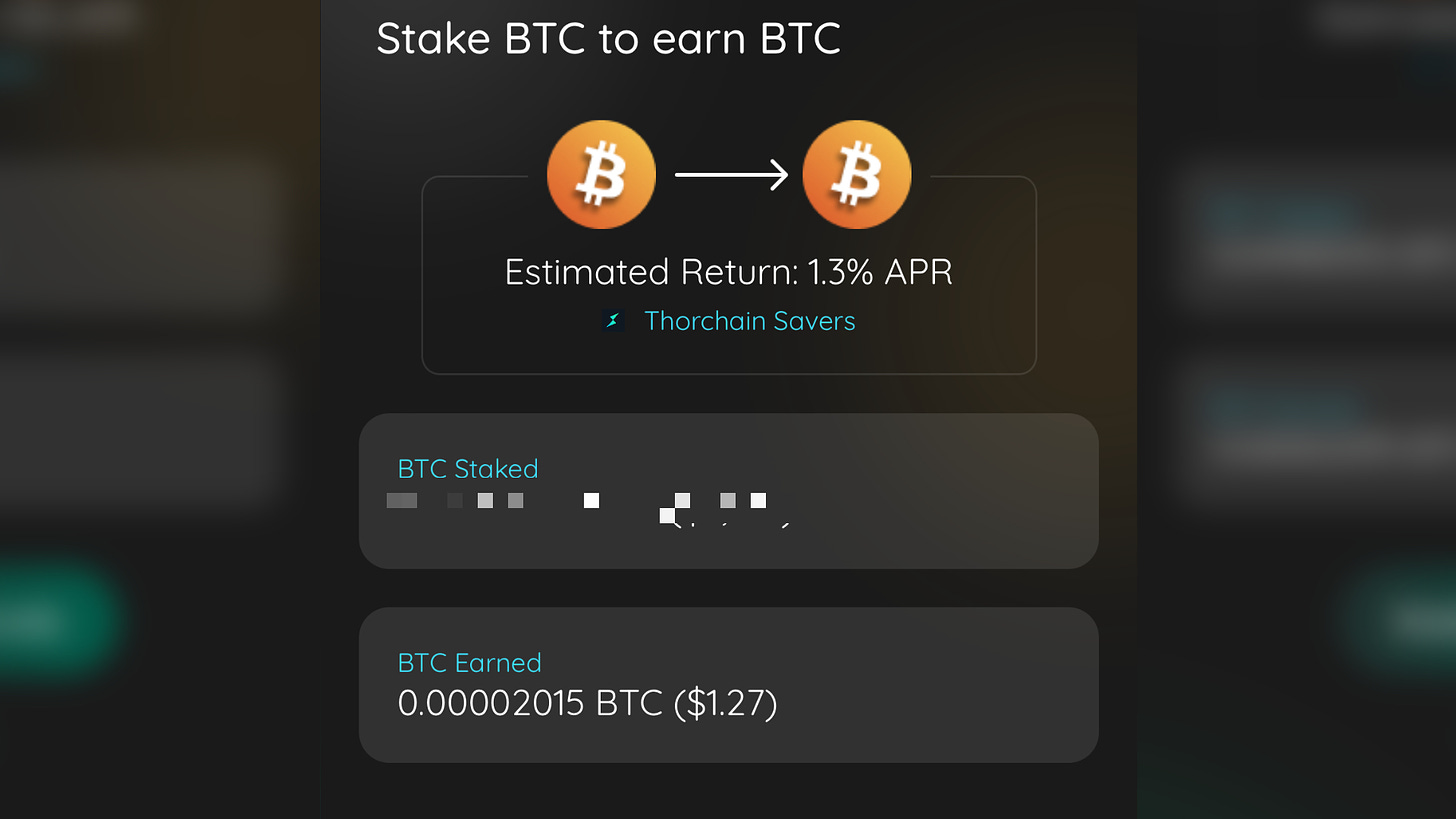

Note: This is not an endorsement of Thorchain. It’s a platform I’ve experimented with. I’m just sharing my experience.

Thorchain

Thorchain is a decentralized exchange, or DEX. It's different from traditional exchanges. It's not run by a company. It's run by code and the users themselves.

How lending works

Users lend their Bitcoin by depositing it into liquidity pools. The pools are used by Traders on the platform. The traders pay fees on each trade. These fees are collected and given to the liquidity providers, aka lenders.

That is the yield.

On Thorchain, the yield is paid in Bitcoin.

How borrowing works

If you need access to fiat, you can borrow against your Bitcoin.

Your Bitcoin is put into the liquidity pool. This allows the protocol to earn yield from swap fees. Doing it this way allows the borrower access to capital without paying interest. Because of the smart contract structure, there is no term on the loan.

Once you pay back your loan, your collateral is given back to you.

Alignment with Austrian Economic Principles

Thorchain fits well with Austrian Economics. It’s decentralized with no central control. Participation is voluntary.

People can choose to provide liquidity.

They assess the risks themselves. They earn yield based on their contributions.

This encourages savings.

People can put their Bitcoin “to work.” They earn yield without relying on a bank or centralized authority.

Dexs, like Thorchain, promote efficient use of capital and supporting economic activity.

If you want to learn more about Thorchain, go here.

Conclusion

Earning yield on Bitcoin, even with a fixed supply, is possible.

Austrian Economics shows that lending and borrowing happen naturally due to people’s time preferences. Interest rates adjust based on supply and demand. Lenders offer Bitcoin to those who need it. Borrowers pay interest for access to it.

Defi platforms, like Thorchain, promote transparency and prevents inflation due to smart contracts. Because of this, personal responsibility and voluntary interaction are needed.

Banks use to be the only way for capital markets.

Not anymore.

Rare Passenger / block height 862 340

Enjoy what you’re reading?

Your support helps keep the content coming and free for all. Consider leaving a tip at livingonbitcoin@getalby.com. Thanks for your support.