Reader,

Bitcoin keeps evolving.

The USD devalues further. $112K USD per Bitcoin.

BTC2025 was revealing. New players. Big players. Big pockets. Landscape's shifting.

For better? For worse? We'll see.

Never a dull day.

The Insight

The vibe's changed.

We see the suits now. They're here. Been here. Just louder now. Front and center. Their voices drown out the quiet ones.

Plebs still asking. Medium of exchange or store of value? It's both. But that's not the debate anymore. What's at stake is your sovereignty. Do you hold your bitcoin or not.

Bitcoin's mainstream now.

They're monetizing it. Making their products. New use cases. Lending. Borrowing. Contracts. There's a picture they're painting. It's not finished but it's got me thinking different.

Like sharks these suits bite. They bite and don't let go. If you give them your coin. They take it. Keep it. Never let go. If you sell it's a one way street. Keep that in mind.

Bitcoin circular economies keep the coin.

Ask yourself who holds the keys.

Toolkit

Tools I'm using. No sponsorships. Just my experience.

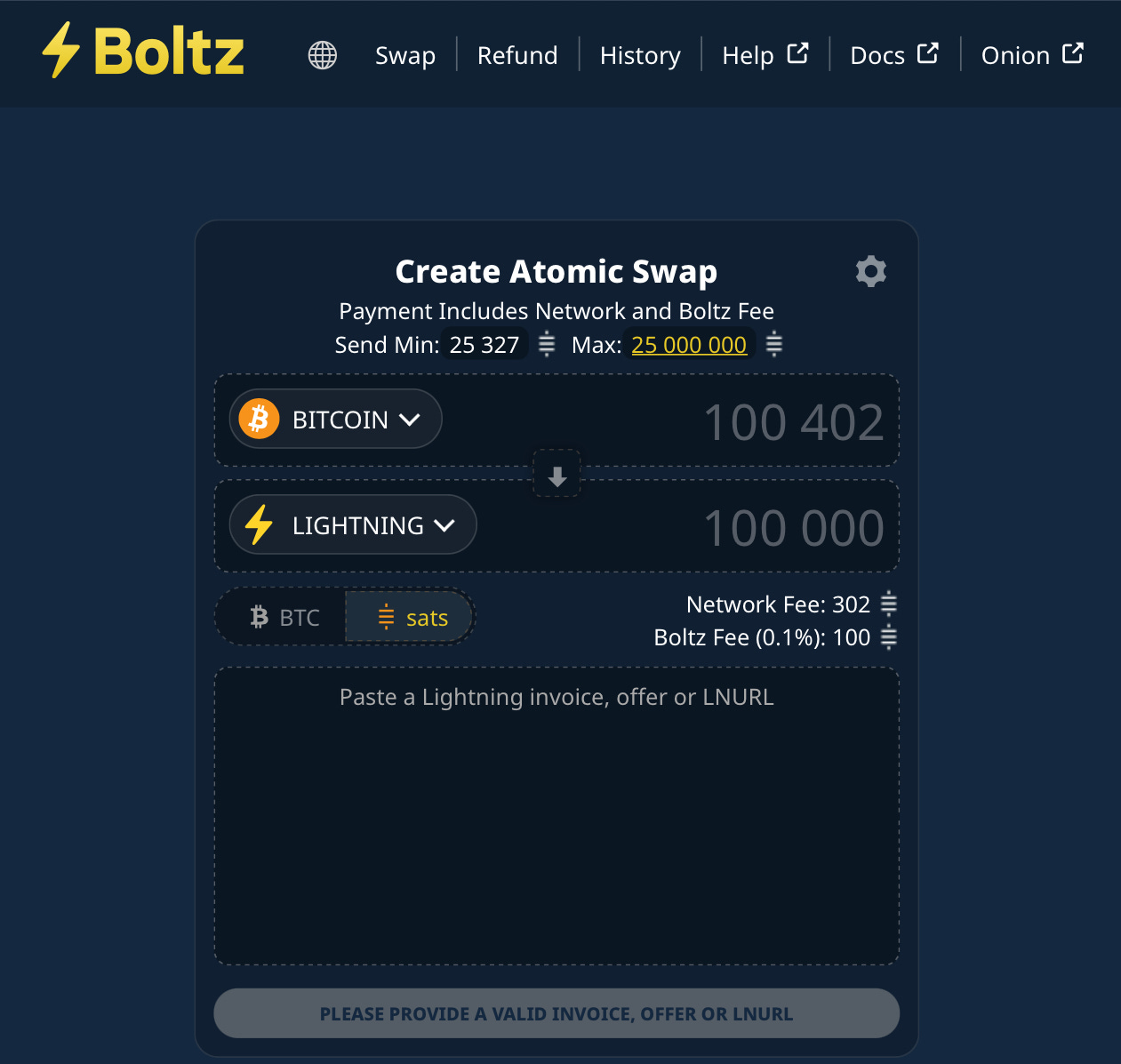

Boltz Exchange

On-chain to LN swap. Real simple. Fast way to top-up LN wallets or open a channel.

Recently, decided to go from Blixt to Zeus. Didn't have any funds. Sent on-chain funds from Sparrow to Zeus via Boltz. Zeus's Lightning Service Provider (LSP), OLYMPUS, opened a channel for me. Simple. A spread on the swap, but worth it.

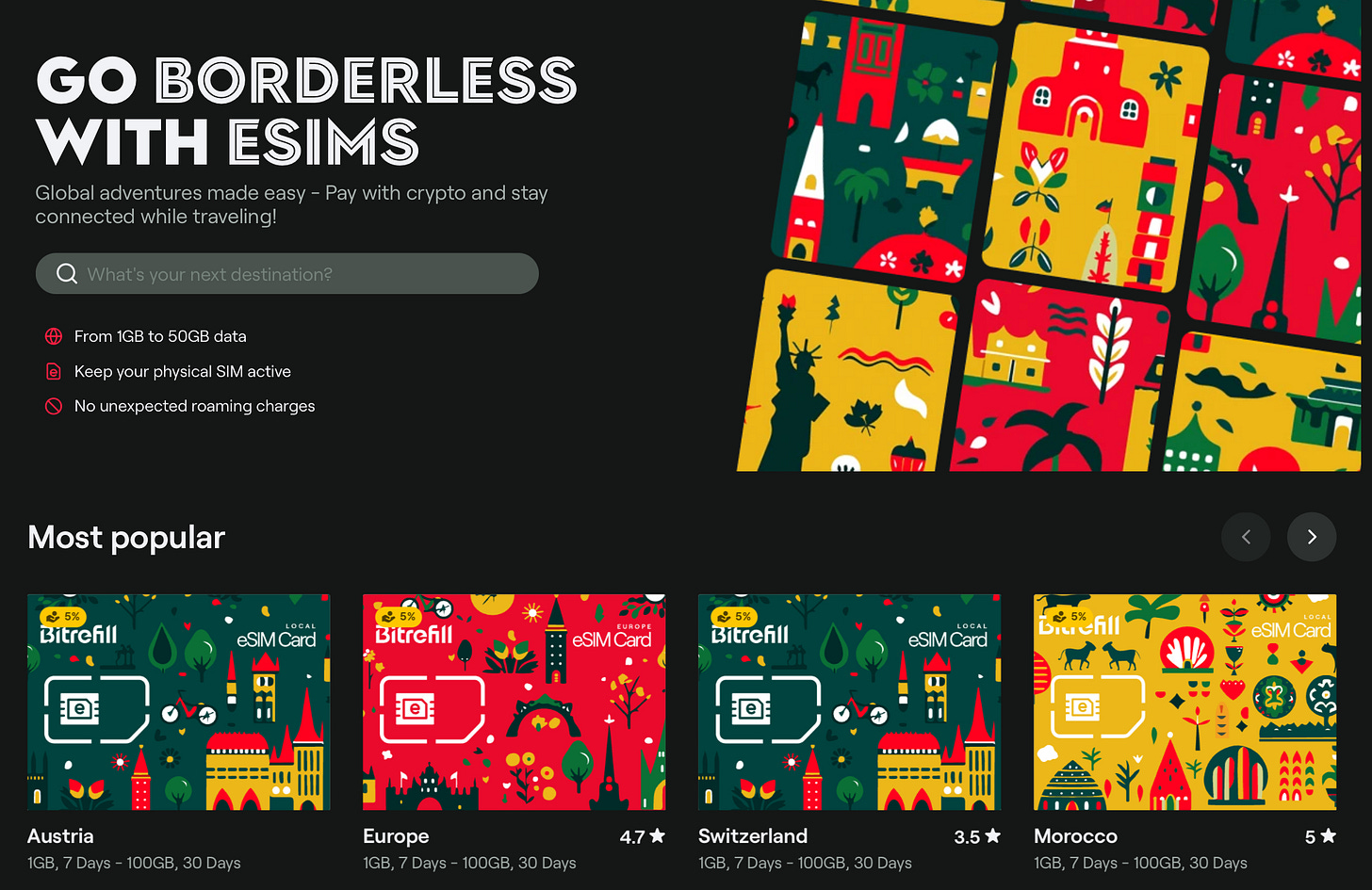

Bitrefill eSIMs

Solid product. Choose a country. Buy the eSIM. Load it to your phone. Done. Helps when globe hoping. Sends data usage when close to running out. Top-ups simple too.

Travala

For booking flights and stays. Pay with Bitcoin directly. Sometimes there's discounts. Been using them for years. Real helpful.

Lessons From The Road

How I'm using Bitcoin now

As loan collateral.

Why?

To know. Form my own opinion.

So far, it's OK. It gets the job done. Just with extra steps.

Taking a loan for consumption, no good. Loan needs servicing. How do you repay? A loan for production, better. There's a way out.

Got a friend making a film. Needed funds to finish. Asked if I'd be interested in investing. I don't have fiat. My coin's in buckets, each with a purpose. But his project sounds fun. His investment plan's good. Repays quick, plus royalties. I'd like to be apart of it. Just don't want to part with my coin, yet.

Took a collateral loan. Used CoinRabbit. Borrowed at 50% Loan to Value. If Bitcoin trades at $100K, you get $50K. His investment ain't much. Low risk. If it goes wrong, won't be weaping. I deposit the coin. Get funds. No questions asked. Make the investment. Deal's done.

Couple months go by. Film productions wraps. Get first repayment. It's enough to pay back loan and get my collateral back. I do.

He got a film made. I made a little income. Win-win.

My coin can be productive. Do productive things. Adds more value. More than just HODLing.

Some will argue against it. Some for it. I don't care. I use my funds how I will.

And that's the point.

Bitcoin's real simple.

You either earn it or buy it. You hold it. In your own wallet. You send it. From your own wallet. Sometimes you spend a little. Sometimes, a lot. Other times, you just stay still.

Running a node ain't hard either.

Download a Bitcoin client. Then the blockchain. Keep it running. Whether it's Core or Knots, preference is yours. Yours alone. Your node verifies. That's what counts.

We—you, me, people—complicate things. It's human nature. It's what we do when we don't fully understand. Study Bitcoin. 10 minutes, 10,000 hours, 10,000 years... Doesn't matter. KYC, non-KYC. Bitcoin is Bitcoin. Fundamentals stay the same. You send it, receive it. Pretty straightforward.

I learned by doing. Walking the walk. Bitcoin’s the class. Volatility the teacher. These days, I don't learn much. Either I'm a bad student, or there's not much more to learn. Again, Bitcoin's real simple.

If you're in the US, Steak and Shake accepts Bitcoin. Feed yourself and your curiosity.

My dad would often say: "You do it, you know it. No what ifs."

Use Bitcoin, even once. You'll know more than 90% of "Bitcoiners" out there.

No what-ifs.

The Essays

Signal

What’s changing the vibe.

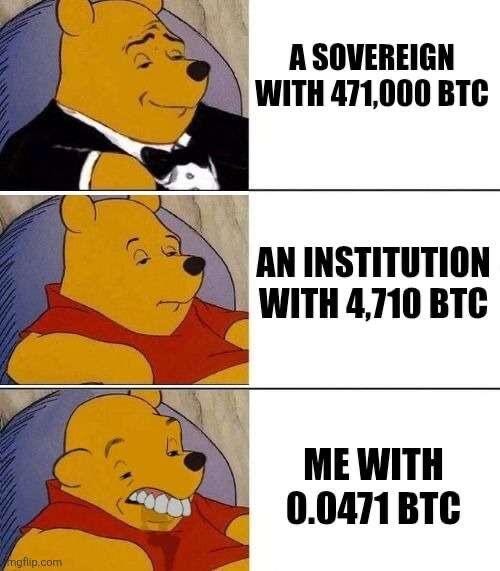

1 - GameStop buys Bitcoin

4,710 BTC in its wallets.

2 - Burgers n’ Bitcoin

Steak n’ Shake stack sats now.

3 - Know Your Coinbase

Social engineer’ed hack. $400M in damages.

4 - Coinbase joins 500

Everyone owns it now.

5 - Cake PayJoins

Adding privacy to payments.

6 - Texas Bitcoin Reserve

Second state to start stacking sats.

7 - JPM Bends Knee

Allows clients to buy Bitcoin.

8 - Missouri To End Cap Gains

Spend your sats. Tax free. Possibly.

9 - Florida to End Cap Gains

Bill to spend Bitcoin freely.

10 - Dubai Takes Bitcoin

Government accepts Bitcoin.

11 - Trump Media Buys Bitcoin

Goes for $3M. Lands on $2.5M

Memepool

Freshly minted. Best shared.

Conclusion

The bigs aren’t coming. They’re here. Here with deep pockets. It’s an arms race for Bitcoin.

The vibes are changing. Once fringe, now global finance.

Remember…

“Stay humble, stack sats.”—Odell

and…

“Not your keys, not your coin.”

The race is on.

Rare / block height 899 367