Break the Cycle: Opt Out of Fiat Currency and Adopt Bitcoin - #209

TL;DR - Life can become more affordable on a Bitcoin standard. Learn about the incredible increase in purchasing power since 2010 and how you can benefit.

Dear reader,

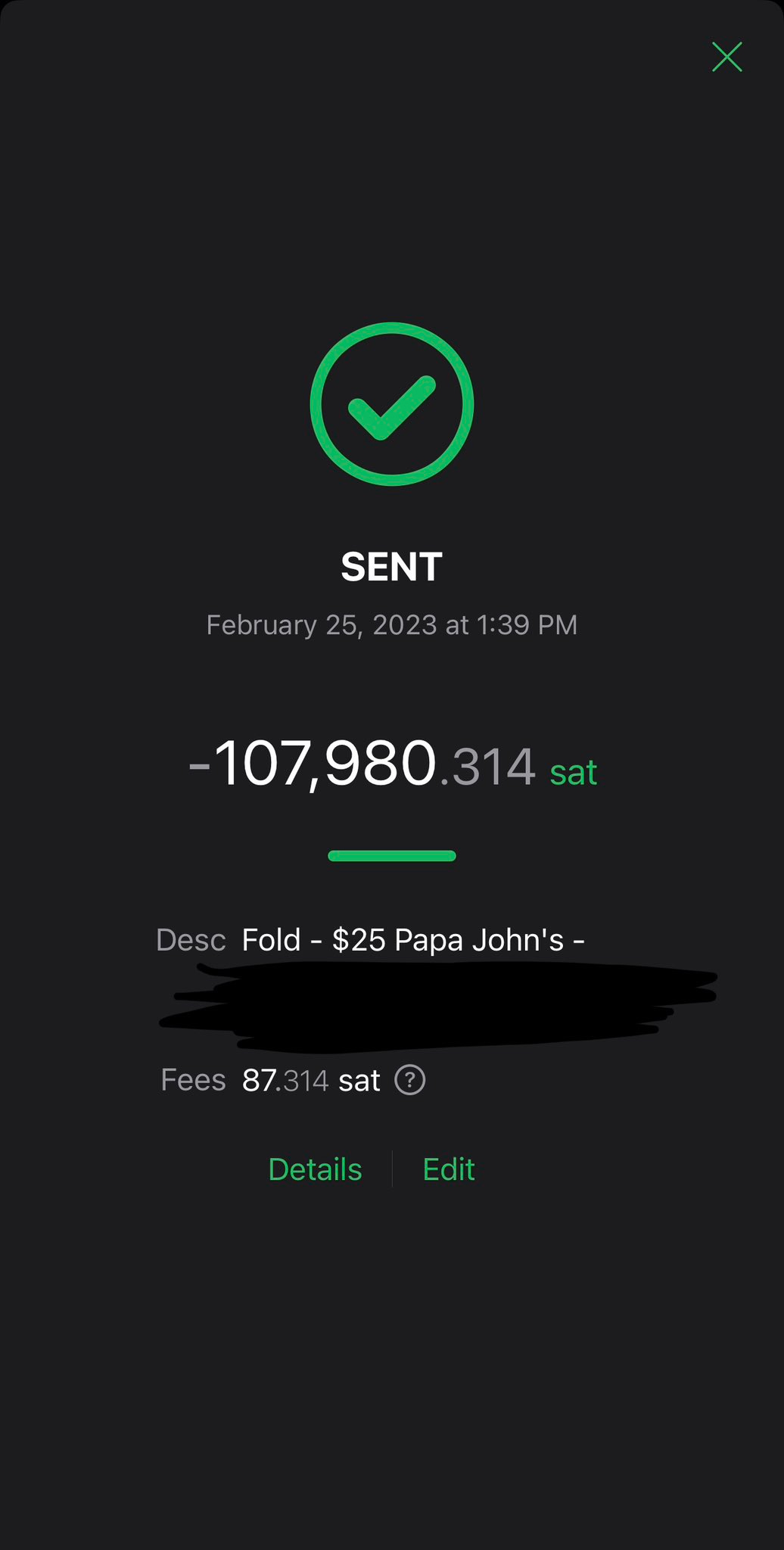

Laszlo Hanyecz made history in 2010 by purchasing two Papa John's pizzas for 10,000 BTC. It was a moment that captured the early excitement and experimentation of the Bitcoin world. Eight years later, he made another pizza purchase, this time over the Lightning Network, for a mere 0.00649 BTC.

And yesterday, in a nod to Laszlo's pioneering spirit, I ordered a Papa John's pizza and paid with 0.001 BTC.

It's a small tribute to the man who helped pave the way for the future of digital currency, and a reminder that sometimes the simplest things, like a pizza, can hold great meaning and significance.

Life is more affordable on a Bitcoin standard

Back in 2010, Bitcoin had no established value. It was a digital currency that few people understood and even fewer used. But Laszlo Hanyecz saw something in it and decided to purchase two pizzas for 10,000 BTC.

At the time, he established its value at $0.0041 per Bitcoin in federal reserve notes. Fast forward to today, and Bitcoin's value has skyrocketed to $23,000 per Bitcoin.

That's a 5,609,756.1% increase in purchasing power since 2010.

Of course, no one could have predicted this kind of growth, but adopting Bitcoin can still result in small incremental increases in purchasing power. For instance, those who adopted Bitcoin in 2020, when it was $8,500, have seen a 170% increase in their purchasing power. And even those who started using Bitcoin during its low point in 2023, when it was $15,000 per Bitcoin, have seen a 53% increase.

It just goes to show that life can become more affordable on a Bitcoin standard.

Fiat is a losing strategy

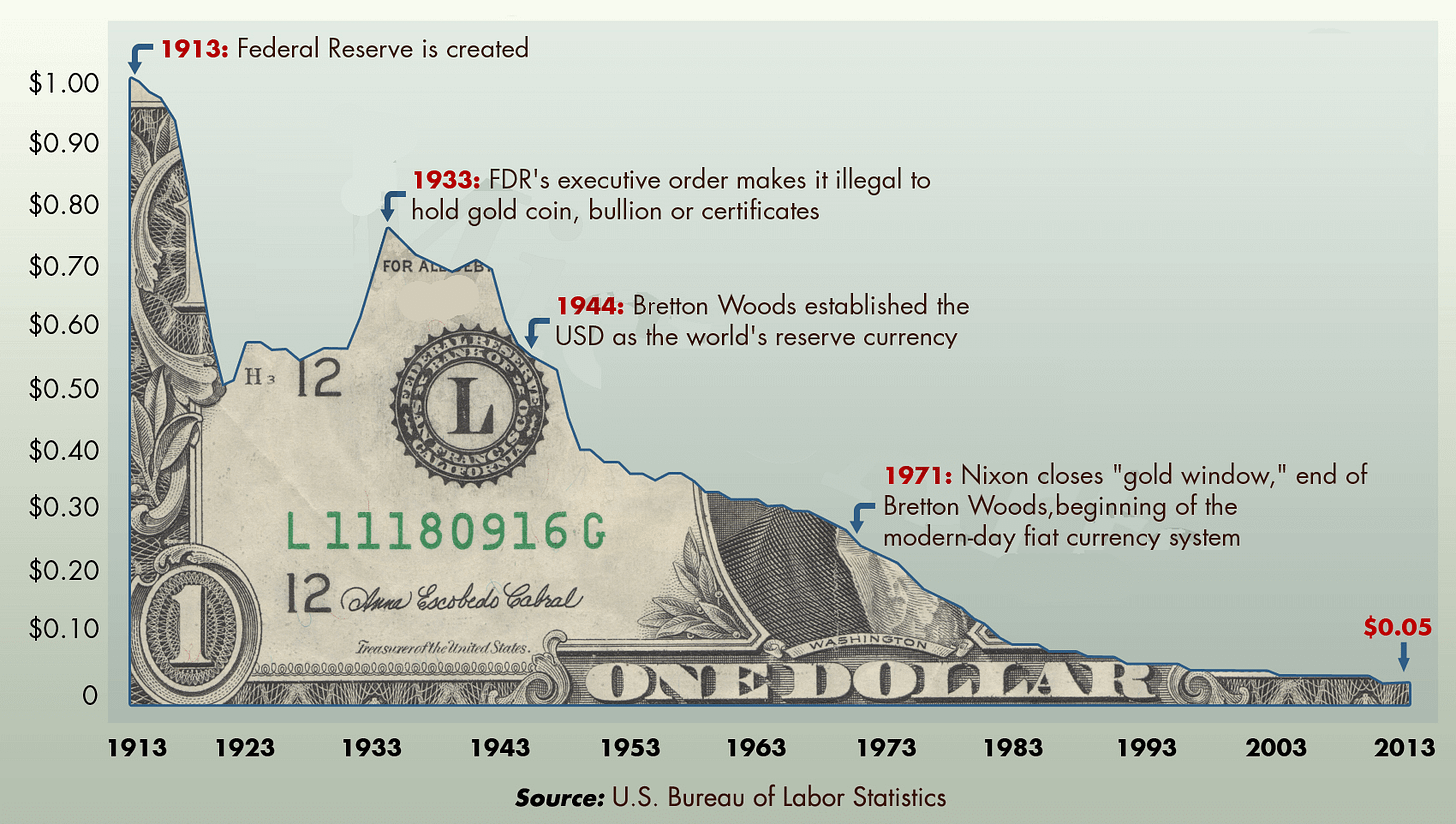

Since 1971, the federal reserve note (aka “dollar”) has lost a significant amount of purchasing power.

In fact, the dollar has lost 650% of its value since the severing of its convertibility to gold.

(image source: http://www.libertyclick.org/)

To put it simply, a good that cost $1 in 1971 would cost around $7.50 in 2023. The math is basic, but the effects are profound.

One of the primary reasons for this loss of purchasing power is the creation of credit by banks, which increases the currency supply and dilutes the value of each federal reserve note. This process is known as fractional reserve banking.

When there are more federal reserve notes than goods and services available, prices increase, leading to inflation. Inflation acts as a hidden tax on people's wages, savings, and overall purchasing power.

Break the cycle

If you're relying on federal reserve notes for earnings, savings, or interest, you're setting yourself up for a loss in purchasing power.

That means you'll have to work harder to afford the same quality of goods and services. You might have to settle for lower quality food, live in less comfortable homes, receive a subpar education, and even resort to risky investments just to find some yield.

But you can break out of this cycle. You don't have to rely on fiat currency.

There are alternative options available, such as Bitcoin.

By opting out of fiat and into Bitcoin, you can protect your purchasing power and work towards a more stable financial future.

It's time to take control of your financial well-being and break free from the constraints of traditional currency systems.

It is essential to take steps to preserve the value of our money and maintain financial stability for the future. That essential step is to opt out of fiat and opt into a Bitcoin standard.

Conclusion

The story of Laszlo Hanyecz's pizza purchases serves as a reminder of the early excitement and experimentation in the Bitcoin world. But more than that, it highlights the potential for significant increases in purchasing power with the adoption of a Bitcoin standard.

With the federal reserve note losing 650% of its value since 1971, it's clear that relying on traditional currency systems is a losing strategy.

Inflation erodes our wages, savings, and purchasing power, leaving us with the prospect of working harder for less.

By breaking out of this cycle and opting into Bitcoin, we can protect our financial well-being and work towards a more stable future.

It's time to take control of our finances and embrace the potential of a Bitcoin standard.

Until next time!